U.S. tries to subsidize local manufacturing of photovoltaics, but it is difficult to get rid of indiAccording to the Financial Times, the U.S. is committed to accelerating the green energy supply chain management counterflow of the new requirements, a short period of time to get rid of the dependence of renewable energy equipment on Chinese imports basically no efficacy.

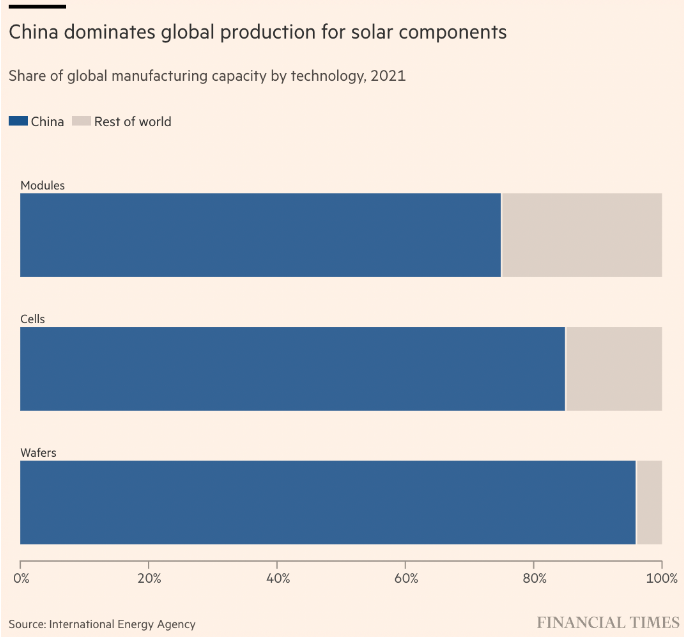

The U.S. National Treasury recently issued a new implementation opinion, requiring U.S. solar energy real estate developers will only be in the case of domestic production of solar cells to obtain the consumer VAT provided in the Inflation Reduction Act. However, analysts revealed that because the U.S. solar rechargeable battery production capacity is very small, the government department this requirement means that basically none of the current real estate developers can be subsidized by the U.S. government. An analyst at Bloomberg New Energy Finance said, "The U.S. will also continue to rely directly or indirectly on the Chinese market for supply." "The latest proposal released by the U.S. National Treasury may encourage more battery manufacturing in the U.S., but most of the rechargeable batteries commonly used in new U.S. solar projects will also continue to originate from Southeast Asian factories, but most of those factories are owned by Chinese companies." The Inflation Reduction Act, a key premise of the Biden administration's attempt to modernize U.S. economic development again and build green energy manufacturing capacity, decrees a 30 percent consumer value-added tax for real estate developers and an additional 10 percent subsidy for companies that apply domestic raw materials. In order to receive the subsidies, 100% of onshore wind farms, solar and battery storage must be made from U.S. steel, and 40% of the production components must be manufactured in the U.S. based on cost considerations. This percentage will increase to 55% for new construction projects that will begin after 2026. The U.S. is attempting to resist China's dominance in the management of clean technology supply chains worldwide by promoting U.S.-made goods. According to the International Energy Agency, China produces the majority of the world's monocrystalline silicon wafers, 85 percent of the cells and three-quarters of the components. China is also a key global producer of photovoltaic cells, an important raw material for solar components.

Wood Mackenzie shows that the U.S. can produce and manufacture 8.9 GW of solar components annually at this stage, fully meeting only half of the country's market demand in 2022, far less than China's 600 GW of production capacity. rystad Energy statistics show that in 2022, 75% of U.S. solar modules originate in Vietnam, Singapore, Thailand and Vietnam. Because of supply chain bottlenecks and U.S. restrictions on solar-related imports into commerce, growth in new solar installations in the U.S. slowed last year for the first time since 2018 to date. a result from Wood Mackenzie and the Solar Energy Industries Association showed that the U.S. added 20.2 gigawatts of installed solar photovoltaic power in 2022, down 16 percent from the previous year. |